BEKNUR NESIPBAYEV, ASTANA MOTORS: “WE CHOSE TO DEVELOP OUR OWN PRODUCTION TO BE LESS DEPENDENT ON OTHER COUNTRIES”

Beknur Nesipbayev, CEO of Astana Motors, spoke to Kursiv about the expansion of Chinese car brands in Kazakhstan, the development of local production and car market trends.

– What share does your company have in the new car market? How are you going to strengthen your position? Competition is increasingly tough, especially with the active entry of Chinese brands offering a wide range of models.

– Astana Motors had a more than 25% share of the domestic new car market in the first quarter of 2024. It was 24.4% according to the results of 12 months of 2023.

Indeed, the market is extremely hot, with the number of cars from China rapidly growing in Kazakhstan. The Chinese segment in the car market is about 40%.

According to the Kazakhstan Automobile Union, the number of Chinese car brands in the country has grown by 7.5 times over the past five years, from two brands in 2019 to 15 in 2023. These brands recorded a 30-fold increase in sales over this period. Today, over 35 car brands sold on the Kazakhstan market include 15 Chinese ones.

From 2021, Astana Motors has consistently brought the leaders of the Chinese car industry to the local market — Chery, Haval, Changan, Tank, GWM. In 2021, Astana Motors dealers sold 1,269 Chinese cars, and in 2023, sales went up to 27,143 units. As our company expanded its brand portfolio, the demand grew, and by the end of 2023, Chery, Haval, Changan took fourth, sixth and eighth places, respectively, in the top 10 brands in the Kazakhstan market.

High competition drives manufacturers because each strives to create a product that offers even more value in performance and quality. For businesses, this is a challenge to develop the service sector.

To level up its market position, Astana Motors primarily promotes loyalty. We obtain and offer consumers new models available globally, and together with finance companies we develop special offers, including ones for businesses looking to expand and upgrade their car fleets. These programs are popular: for example, 60% of all cars sold in 2023 were purchased by customers on credit.

We have implemented one-stop service and an electronic digital signature in our dealerships; we keep a stock of original spare parts at all times, and our service technicians are certified to international standards. The Astana Motors contact center is always available and processes about 550 requests daily thanks to a centralized system with a common database for front office, contact center and service support managers.

– How is the localization of auto components for the cars you make progressing? What is the current average level of localization and what components are already produced within the country? What components are you going to make in Kazakhstan?

– The global crisis associated with a shortage of components and logistics problems has exposed the problem of globalization. For us, this confirmed that we made the right decision — to develop our own production, foster a school for mechanical engineering personnel, introduce CKD production, localize auto components and establish logistics in order to be less dependent on other countries. And talking about the future of our country, this is not only a matter to consider for the automotive industry, Kazakhstan people must give serious thought to it, master competencies and develop the production of other goods, including technically sophisticated ones.

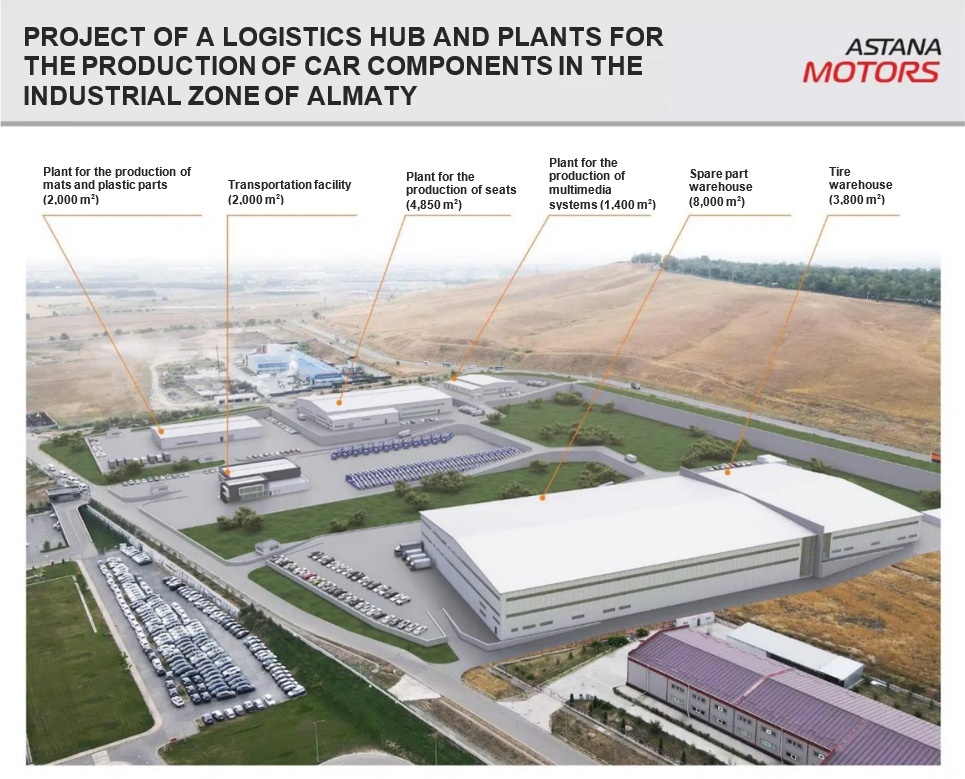

Astana Motors is at the final stage of building a technology park in the Industrial Zone of Almaty. At the end of 2024, we will begin producing car seats, polyurethane mats, wheel arch liners, mudguards and car multimedia systems with an output of 100,000 sets per year. As the first step, our goal is to meet the domestic market needs for auto components, and in the future we plan to export to the neighboring countries.

We are implementing the project for localization of auto components together with experienced South Korean manufacturers Youngsan Glonet Corp. Ltd. and Motrex Co Ltd.

– In one of your comments to the media, you said that localization will reduce the impact of currency fluctuations, which means that it will also have an effect on the price. Please tell me if you can state this effect in percentage?

– Like manufacturers in other countries, including the major global giants, we are affected by the situation in the global market, and it often brings uncertainty and risks associated with volatility, geopolitics, financial and economic changes and their impact on the availability, cost of components and logistics. Therefore, we put a lot of effort into localizing auto components as much as possible, since it will reduce the impact of currency fluctuations and logistics issues. For example, the cost of logistics for one car seat will be reduced by 50%, from $330 to $165, that is delivery costs will be half as much.

– The construction of a multi-brand car plant is currently underway. When is the plant planned to be launched and what is its capacity? Why was it decided to build this plant and how will it help upgrade the vehicle fleet in Kazakhstan?

– Yes, the Astana Motors Manufacturing Kazakhstan (AMMKZ) multi-brand plant is being constructed on an area of 309,000 sq. m in the Industrial Zone of Almaty. We plan to launch the production of Chery, Haval and Changan cars and a number of GWM models in the first quarter of 2025. As the construction of the plant started, we planned to produce models of three popular Chinese brands and over time concluded an agreement to produce models from the Chinese car giant GWM, specifically, the Tank 300 SUV.

According to our plan, we will export 60% of the cars made by AMMKZ to the CIS countries and 40% to the domestic market. This will have a positive effect on the upgrading of the domestic car fleet.

The production area is 209,000 sq. m, the capacity is 90,000 units per year.

In 2023, in Xi'an, as part of President Kassym-Jomart Tokayev’s visit to China, we signed technical licensing agreements with Chery Automobile Company, Great Wall Motor and Changan International Corporation and entered into an agreement with Automotive Engineering Corporation to supply equipment to the multi-brand plant in Almaty. I would like to note that Automotive Engineering Corporation supplies high-tech equipment to the world’s leading car makers — BMW, Toyota, Jaguar, Land Rover, Hyundai, BYD, Mercedes-Benz and Volkswagen.

In addition, we agreed on the supply of equipment with Siemens (Germany), ABB (Sweden/Switzerland), Schneider (France), Omron (Japan), Fanuc (Japan).

The decision to build Astana Motors Manufacturing Kazakhstan was discussed at the level of heads of state during the visit of Chinese President Xi Jinping to Kazakhstan.

Astana Motors will invest 182 bln tenge in organizing the enterprise according to the standards of China’s leading car makers. We localize cars of popular brands in order to create a cluster for small- and medium-sized businesses in Kazakhstan: this is the operating Hyundai Trans Kazakhstan plant, and Astana Motors Manufacturing Kazakhstan and car component enterprises, which are under construction. These are real opportunities for economic development and the formation of a pool of qualified mechanical engineering personnel.

Engineering and technical specialists at our enterprises adopt the experience of leading automakers and develop technologies in Kazakhstan. In total, Astana Motors’ technology park will employ about 6,000 people in the production facilities, as well as thousands of workers due to the multiplier effect.

Local and foreign investors see potential in cooperation with our enterprises. And we are open, and consider proposals and advise businesses as official representatives of brand holders. For example, Hyundai Trans Kazakhstan is testing Kazakhstan-made Bars batteries from the Taldykorgan manufacturer Kainar-AKB. Of course, the plant strictly complies with the high quality standards of the brand holder Hyundai Motor Company (HMC). The battery is a complex technological product, and before we can use it, we must conduct tests in Kazakhstan and South Korea and obtain HMC accreditation. We are doing this joint work because domestic manufacturers of car components are interested in cooperation with us, and we want to develop the industry in Kazakhstan, and we need car components made in the local market.

– How does the industrial assembly regime encourage the domestic automotive businesses to deepen localization?

– Localization is a labor-intensive process that requires a high level of competence and expertise. For Kazakhstan, this direction is relatively new compared, for example, with South Korea and China, where car makers went from the very start to becoming a global auto giant, and it took them about 50 years.

Hyundai Trans Kazakhstan, a subsidiary of Astana Motors, has been operating since 2020 and in its first year of operation introduced CKD production with body welding and painting. It includes more than 700 production operations according to international HMC standards.

Our main goal is to achieve 51% localization through the production of car components. In 2023, Hyundai Trans Kazakhstan increased its production capacity to 50,000 cars per year. We are currently upgrading our workshops to further increase their capacity and weld and paint more models. In addition, we will purchase new equipment to partially automate production processes in our welding and painting shops.

Along with the commissioning of Astana Motors Manufacturing Kazakhstan and after the expansion of Hyundai Trans Kazakhstan, both plants will make 140,000 cars per year using CKD assembly. This critical volume will be a transition point to the development of body part stamping in Kazakhstan.

We are also investing 6.8 bln tenge in expanding production at the Hyundai Trans Almaty commercial vehicle plant, building new welding and painting shops with cataphoresis baths. The total production area will ultimately be 13,518 sq. m.

Moreover, Hyundai Trans Almaty will produce auto components for commercial vehicles and is negotiating with potential partners.

At the first stage of development, the automotive industry of Kazakhstan introduced CKD technologies, and now, with sufficient competencies and expertise, we have approached a key stage in the development of the industry — the localization of car components when local enterprises move to more sophisticated production. Thus, domestic plants will be able to replace components supplied from abroad.

The Kazakhstan government is gradually tightening requirements for automakers in terms of localization. We agree with this and strive to become a positive example in this for the entire market.

– Your portfolio includes brands from Chinese, Japanese, Korean, and European manufacturers. How have the preferences of car owners in Kazakhstan changed over recent years regarding car brands? What are the sales statistics of the brands in Astana Motors’ portfolio and what are the top 10 brands in the portfolio?

– With Hyundai recording top sales in the car market in 2023, it is clear that the Kazakhstan people prefer locally made cars of this South Korean brand. We are proud of Hyundai Trans Kazakhstan’s achievements; it is a strong team of professionals truly passionate about the automotive industry. Over the past five years, Hyundai has increased its sales in Kazakhstan by 5.5 times, with its market share going up from 14% to 23.5%. In 2023, the brand’s sales grew by 62% compared to 2022.

Sales of Chery, Haval and Changan have increased significantly: last year, they entered the top 5 brands in Astana Motors’ portfolio. In the summer of 2024, we plan to start selling BYD new energy vehicles and are already receiving requests from Kazakhstanis, who are interested to learn about the model line and prices, and are even postponing car purchase until this particular brand appears.

Our other subsidiaries are also successfully developing, supplying the market with new products, and we are grateful to our customers for being loyal to the brands.

– What general trends do you currently see in the Kazakhstan car market? How much more affordable have new cars become, does it have an effect on the used car market?

– First, the share of new car sales has increased significantly due to more affordable prices, financing programs and promotions offered by brands.

With the development of consumer culture and social networks, buyers have become more selective and demanding. It matters to them whether the company cares about the client and is ready to support them during and after the purchase. A number of our distributors have communities and are constantly in touch with customers.

There has been a noticeable increase in interest in “smart cars” and technologies that have already become a distinctive feature of brands. That is Kazakhstanis appreciated the convenience, safety and resources of new cars, as, in fact, everything that a modern person is accustomed to using in an accelerating world, where mobility and comfortable living and working conditions are important.

Kazakhstanis show increasing interest in new energy vehicles (NEVs), but most consumers have doubts about purely electric vehicles. As for us, we see potential for plug-in hybrid vehicles (PHEVs) equipped with a gasoline engine and an electric motor with rechargeable batteries. Many of our potential clients are looking for just such models, because in Kazakhstan, with its wide open spaces and actively developing domestic and business tourism, car owners expect frequent long-distance trips.

Another positive trend is that consumers prefer authorized dealers, that is they trust us. More Kazakhstanis do not want to risk buying a car from an unverified seller and go to official representatives of brands, because it is reliable from a legal point of view, it is a guarantee of quality and service. We are developing dealer networks in Kazakhstan, as well as in Uzbekistan, where we represent the BYD brands as a dealer and Hyundai as a distributor. Astana Motors dealers provide legal compliance in deals, warranty support and servicing. They have 6,000 employees in two republics.

Source: kursiv.media